An Efficient Sample Answer to Summons for Credit Card Debt

If you have ever been served a summons, it can be a very unsettling experience. In most cases, someone shows up at your home or place of employment and formally serves you. This means they hand you a piece of paper and witness that you receive it. Often you have to sign a piece of paper. Usually, being served is not a result of something good. For purposes of this article, we are talking only about receiving a summons in relation to credit card debt. When you have been served with a summons for this, you may have a lot of questions about your next steps. Continue reading this article to find out what you should do next.

Before we can get to the sample answer to a summons for credit card debt, it is essential that you understand a summons.

What is Summons?

A summons can occur when you are no longer paying your credit cards or unsecured loan. This is also referred to as being in default. The original lender considers it a loss and charges it off. Depending on the lender, this can happen at different stages. For some lenders, you stopped paying on your credit card 90 days ago, and they may put you in default. For other lenders, it could be close to a year before it gets to this stage.

When you receive a summons, you are being sued for defaulting on the money you borrowed. The summons contains information about who is suing you, why, and for how much money.

Review Summons Carefully

When you receive the summons, it is essential that you carefully review the document to ensure it is correct. If you do owe a debt to the company, organization, or individual listed on the summons, you want to start collecting your own information. Any information you have about the debt, including the initial contract with the amount and dates. You also want to organize a record of every payment you made and the date. It is also a good idea to understand your current financial status and budget. It is still your responsibility to pay the debt because you said you would. You need to know how much you can afford to pay.

Settle the Summons

If you agree this is your debt to pay and the amount is correct, it is in your best interest to attempt to settle the debt with the creditor. This will prevent you from going to court and paying fees associated with the court, even if you do not obtain a lawyer. Before you contact the company, you want to assess your financial situation if you have not already done so. Some creditors will accept a reduced payment if you can make one lump sum amount. Sometimes, they will accept a reduced payment if you can make it in several smaller amounts.

Depending on who owns the debt, the creditor may be willing to take anywhere from 40 to 80 percent of the debt. When the debt has been sold to a collection company, they are usually more willing to take a smaller amount because they bought the debt at a lower amount. If it is the original owner of the debt, they typically want more money.

Affirm the Summons

If you know the information, especially the allegation contained in the summons, is correct, you must answer the summons with facts. For a sample answer to a summons for credit card debt, when you affirm the information contained in the summons, you can simply write the term “admitted” next to each bullet item. You can also write out a sentence to explain which statements in the summons to which you are admitting. An example of a sentence could be “defendant admits they reside at” and then list the address contained in the summons.

You can also submit admission with the defense. This could help you if you plan to go to court. It means you are admitting to the allegation, but you have a defense for it. Some of the defenses could be that it is not your debt, you have paid the debt, or the statute of limitations is over. An example of your response could be, “defendant admits to the debt, but it was paid on X.” You want to fill in the date the debt was paid in place of the X.

You Can Pay Off Debt Sooner with the Right Tools.

Debtry Can Help.

Deny the Summons

If the summons is not true, your sample answer to a summons for credit card debt should include your denial of the claim. You should only deny the claim in the summons if it is entirely untrue. If you think or are not sure if it is inaccurate, you should instead reply with a lack of knowledge. You must be able to prove the claim is incorrect if you deny it. You can also use this option if you are an authorized user but did not spend the money in question. Similar to affirming the summons, you can write “denied” next to each bulleted item. You can also write out a complete sentence.

Reply With Lack of Knowledge

When you are not sure about the allegation, no matter if it is the amount, the time, the allegation itself, you can state that you do not have a lack of knowledge. You can write, “defendant lacks sufficient knowledge to confirm or deny the information in this allegation.”

How to File Summons

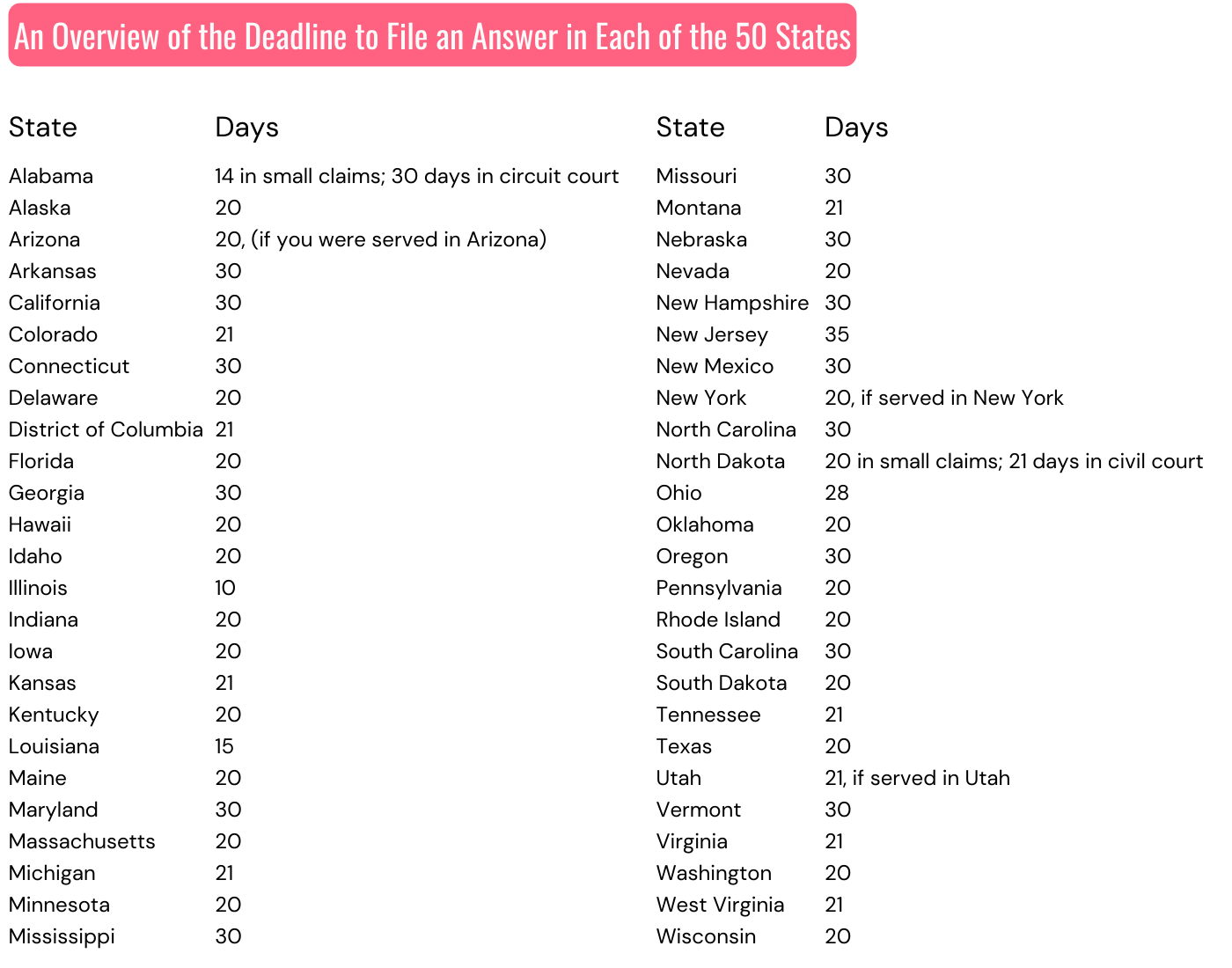

If you attempt to reach a settlement with the debtor, but it does not work out, or perhaps, you choose to go to court, you must file a response to the summons. The answer must be filed with the court system. The answer must be received within a certain amount of time of receiving the summons. The amount of time depends on where you live. You must respond to every allegation in the package. Your answer must be typed and printed.

What Happens if I Do Not Respond?

It is not advisable that you ignore the allegation. You must respond to it. If you ignore it, there will be a laundry list of things that may happen in response. You may find that your wages are garnished, liens on your property, or levies against your bank account. The court can enter a verdict against you if you ignore the allegation. It is better for you that you settle the debt or handle the allegation through the court system.

How to File Your Answer with the Court

After you’ve reviewed the complaint and written your answer keeping in mind the contents and allegations made in the complaint, you need to file your answer with the court. The court may have set a deadline for you to file your answer so make sure you don’t miss it. To properly file your answer, do the following:

- Print out your answer in 2 copies

- Make sure everything is covered and the info your provided is correct

- Sign both copies and submit one two the court and the other to the debt collecter

- File the answer with the clerk and prepare for the filing fee beforehand

Need More Assistance?

A summons is scary, and you may not feel like you have enough information with this article. The Goalry Mall has more information available for you on our website. We have articles, videos, and other information on our website that can help guide you through the steps of a summons and how to resolve the allegations. If you need more assistance, live support can help you with any questions you may have. There is no shortage of information available to you, including ways to create a budget and meet your financial goals.

Conclusion

When you receive a summons as a result of not paying credit card debt, you must remain calm and address the summons. You want to make sure you address every allegation in the summons. It is not wise to ignore a summons you receive. You should also address every allegation in the summons.