Credit Card Debt

We have a real love/hate relationship with credit cards in the United States. On the one hand, more Americans than ever before are drowning in credit card debt. Our collective balance is over a trillion dollars. If each dollar could buy one mile, we could fly to Jupiter, realize we forgot our phone charger, fly back to earth to grab it, and get back to Jupiter before we ran out of dollars.

It’s a lot of credit card debt.

The average American has four credit cards. If you only have two, the guy across the street probably has six. The average credit card has a balance of over $6,000. That’s per card. Just to keep things interesting, credit card companies keep raising our limits and allowing higher and higher balances, because why not?

Like fast food or reality TV, a little is fine but too much is, well… too much. And yet we just can’t seem to help ourselves. We have a crush on paying with plastic. The results have a crush on us as well – one far less pleasant than high school flirting or unexpected flowers. Too many of us struggle with settling credit card debt, whether it’s in the hundreds or the tens of thousands. Americans are many things, most of them wonderfully red, white, and blue. But we’re also largely a nation of impulse-spenders and short-term planners, and it’s already biting many of us in the wallet.

Thanks to the wonders of the 21st century, you don’t necessarily have to wait on your monthly statement to arrive in the mail to check your balance. You don’t even need to wait until you get home to your desktop computer.

Imagine being able to check your credit card balances, available credit, and current interest rates as easily as you check for new baby pictures or cat videos on social media. Imagine alerts whenever payments are coming due or anything unexpected happens on your account. Imagine helpful tips to reduce credit card debt and to encourage you to stay the course and strive to get out of credit card debt.

Imagine a credit card debt reduction app that integrates seamlessly with any related financial software or apps you select. Imagine that it’s not just about this debt or that investment or one specific tax issue or another frustrating mortgage question. Imagine unified finance, at your fingertips – powerful enough to adapt to your specific circumstances but intuitive enough that you can begin benefiting almost instantly.

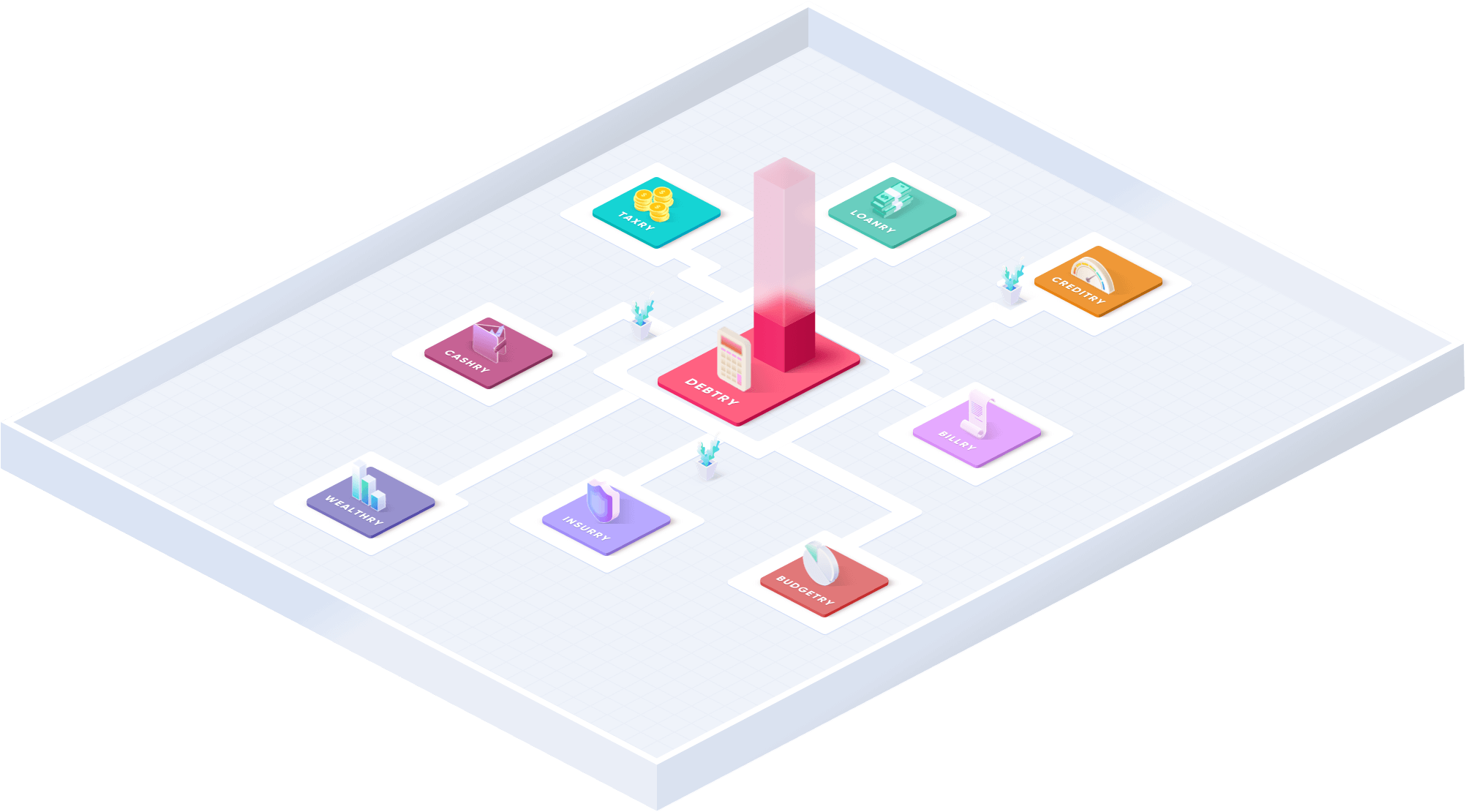

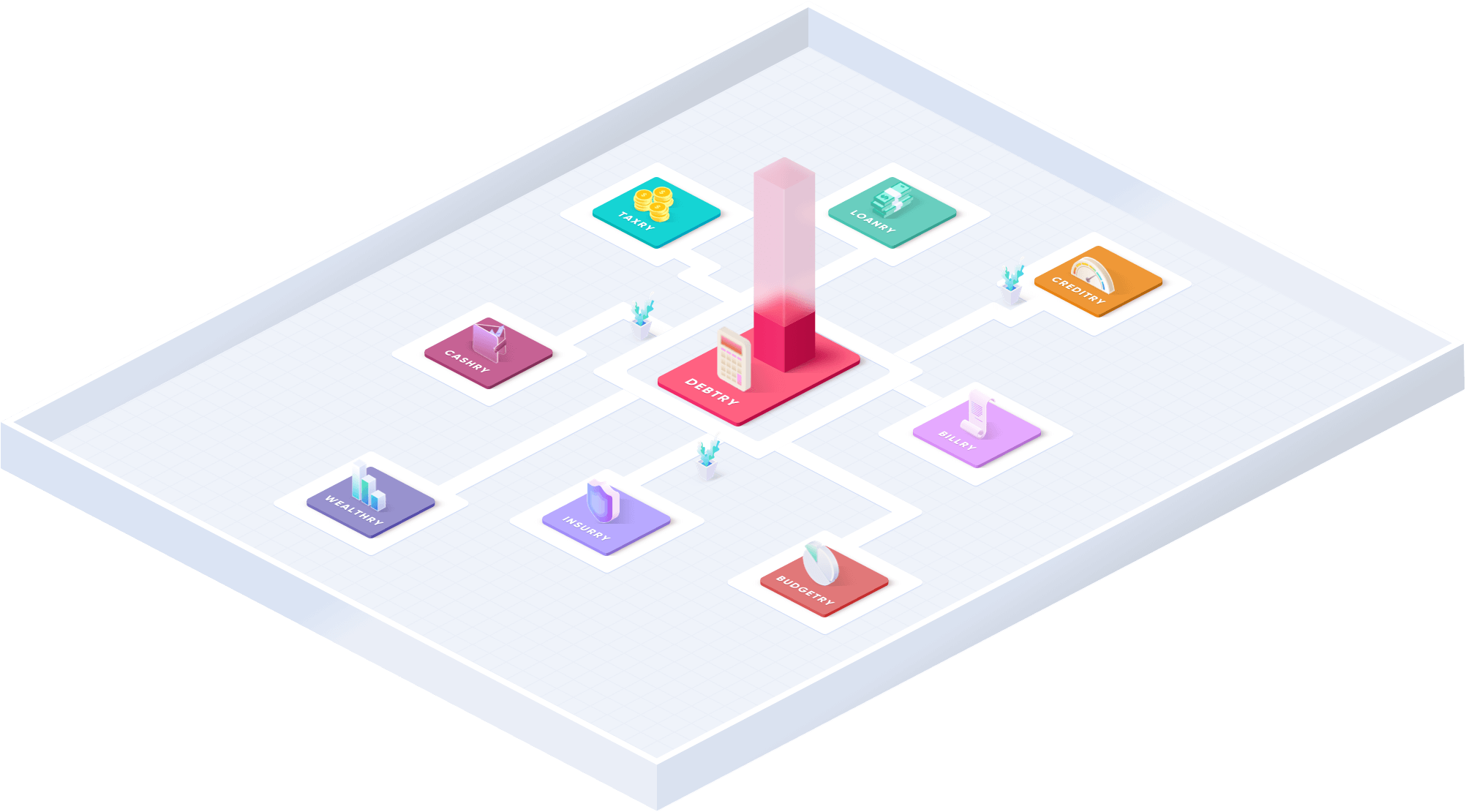

At Goalry, we have a rather lofty vision. We believe that most of us, if provided the right information, tools, opportunities, and connections, can take more effective control of our personal and small business finances. We believe that personal and small business finance may not always be easy, but it doesn’t have to be as hard as it often seems. We also believe that no one should have to figure it all out alone.

Too many financial services or lender marketplaces segment every part of personal and small business finance, as if they’re not all about the same thing in the end. Our debt, our investments, our taxes, our real estate, our savings, our loans, our budgets – they’re all about us figuring out how to best use our resources to care for those we love and to maximize our options going forward in life.

That’s why Goalry has created what we think of as a Unified Finance Mall – ten specialized sites, each focused on a key element of personal or small business finance, but tied together in form and function, and accessible with a single log-in.

If you came here today looking for the best credit cards for a balance transfer, or how to compare various perks or interest rates of the offers you’re receiving in the mail, or even the best ways to pay off credit card debt, we’re glad you’re here. We can help with those things. Those are major parts of what we do here at Creditry. But please know it doesn’t have to stop there. When you’re ready, let’s talk home equity. Let’s talk about minimizing your tax burden. Let’s talk about investment options for normal folks – yes, people very much like you.

But first, let’s see what we can do to move towards some lower credit card debt. Are you ready?

Credit card use isn’t inherently evil. When used responsibly, credit cars can be wonderful financial tools. Online shopping would be a very different experience without plastic, as would booking a vacation, planning a wedding, or taking friends out to dinner. Some cards offer useful perks and most provide partial protection against fraud or theft.

Most of all, however, they’re just so darned convenient. It’s their greatest strength and most compelling danger. If you can completely eliminate credit card debt and still do the things you want to do in life, that’s awesome. We can help with that. Maybe the best approach for the rest of us, however, isn’t to focus on becoming 100% credit card debt free. Maybe the goal should be for us to take control of our credit card debt instead of our credit card debt controlling us.

So what is it about these cards that makes it so easy to end up overwhelmed and so difficult go get out of credit card debt?

With most loans, you request a specific amount from the lender, who either approves or denies your request. If approved, you agree to pay back the borrowed amount in full, plus interest, in a set number of months. You get the full amount of the loan up front, then on the same day each month, you pay part of it back. Some of each payment goes to interest, the rest goes to your principle – what’s left on the original amount you borrowed. Eventually, if you make your payments each month, the balance is zero and you are paid in full. If you want more money at any point, you have to ask again and start the process all over. Not so with your credit card. Although you’re assigned a maximum credit limit, how much you owe each month depends on your balance. As you use your card, your balance grows. When you pay towards that balance, it goes down a bit – but the money becomes available to you again! You can spend, pay interest on, and repay the same money over and over again, indefinitely. Each monthly credit card bill includes a “minimum payment due,” which looks a lot like the required payment on any other loan. Making that minimum monthly payment, however, will not result in your card being paid in full anytime soon. Paying the required minimum towards a balance of even a few thousand dollars usually means paying just enough to cover some interest and fees and a token sliver of your balance. Even if you never use your card again (which, let’s face it, is unlikely), it can take years and years to pay off your debt this way. You simply cannot reduce credit card debt by making the minimum payments. You cannot reduce credit card debt until you stop using your card for most things and only pull it out when you’ve decided in advance that it’s the most strategic thing to do.

When we feel overwhelmed, it’s easy to manage everything as if we’re playing a life-size game of Whack-A-Mole. A bill arrives, and if we’re able to handle it, we write a quick check and hope it goes away for a while. A crisis pops up and we fork over whatever cash is required to get through it. The day’s schedule gets out of control so we order pizza or opt for drive-thru – just put in on the card. There’s no shame to doing our best in complicated times, but it’s time to step back and recognize that there will be no real progress until we have at least three things: (1) clarification and information, (2) a meaningful plan, and (3) the will to follow through. Any realistic effort to lower credit card debt has to start with a functional household budget. We carry on about this quite regularly around here, so if you’re not sure where to start, you can find information and inspiration on nearly every Goalry page. The short version is this: until you know with some accuracy how much you bring in each month and where each dollar goes, you can’t make meaningful changes to your spending or your finances. Budgets aren’t about anyone else telling you how to spend your money. Quite the contrary. Budgets are about you making it clear to yourself exactly how you spend your money so you can decide whether or not the current approach is working for you or not. If you’re here looking for ways to pay off credit card debt, then the answer is no, your current approach isn’t doing so well. If it were, you’d be on the “Ways to Invest All That Extra Cash I Have Laying Around” page instead. Knowledge is power. Ignorance is powerlessness. You have the information, it just needs to be organized into a useful format and you have to confront it. Own it. Confess it. It’s not always easy finding out what our real priorities are, compared to what we hoped they were. It is an essential part of the process, however.

Sometimes the math tells us the problem is more serious than cutting back on streaming services or mowing some extra lawns. Maybe the reason you need help with credit card debt is because you need help with credit card debt! Most areas have local credit counseling services which can help you figure out your current debt. Even bankruptcy can often be avoided with the help of reputable organizations. The best ones are transparent about the requirements and don’t make lofty promises to justify big fees. They can help you work out a repayment plan and often have leverage with credit card companies and other creditors that individuals may not. The fact that you’ve joined a credit counseling program gives them some leeway negotiating credit card debt on your behalf. You may be required to attend a few financial literacy classes or do some work online, but that’s not such a bad thing, is it? In some situations, transferring multiple balances to a single card might give you the flexibility you need to get rid of credit card debt, or at least cut it down to manageable size. By combining several high-interest cards to a single card – maybe even one with a low introductory interest rate – you’ll have a year or more to apply as much as you can muster towards paying credit card debt. Keep in mind that balance transfers don’t make the debt go away – they merely consolidate it so you’re paying it all in one place each month. In extreme cases, a debt consolidation loan may allow you to take back control over your debt. Like a balance transfer (but one not limited to credit cards), these allow you to pay off multiple creditors and instead make a single payment each month. Again, the debt doesn’t go away. It’s just reworked and rescheduled to make it more manageable. Sometimes, access to a consolidation loan gives you the leverage to negotiate a credit card debt settlement with one or more of your card providers, in which they offer you a discount on your total balance in exchange for paying it in full immediately. We discuss these and other options at length in our blogs – always honest, always real, and always in plain, simple English.

As with so many things, there are strategies for paying credit card debt, even when it seems overwhelming. None are as easy as we might like, but neither are they as complicated as some services would like for you to believe. The best way to pay off credit cards is methodically and consistently over time. The best way to pay off credit cards is to reshape how we think about money and how we think about credit card debt in the first place.

The biggest investment on your part will be time and focus, although most will require changing your approach to spending as well. Then again, that’s the solution to quite a few sources of stress and worry, isn’t it?

Next, gather your credit card statements, whether online or on paper. Note your balances, interest rates, and other relevant information. Make note of when payments come due each month. Look at your budget to see how much you can realistically apply towards those cards. If it turns out you can at least make the minimum payments, plus a little extra if you squeeze, there are several strategies for how to best move forward. We discuss these in greater detail on our amazing Debtry blogs.

You may discover you don’t actually have enough income to cover your minimal obligations. If that’s the case, we need to look at ways to either lower your expenses, increase your income, or both. As you might have guessed, these are popular topics on Debtry and across the Goalry universe as well. Sometimes there are major ways we can impact our monthly obligations – those critical turning points when we’re buying a home or vehicle or making career decisions. Other times, however, debt or the elimination of debt come through a multitude of small, daily decisions. Baby steps we take over and over.

Like our health, weight, or relationships, there may be dramatic moments, but most of the truly important changes come in the little things that happen repeatedly. Spending an hour on the phone with the cable company to work out an arrangement that lowers your bill $12/month many not seem like a game-changer, but it adds up. Taking your lunch to work four days a week instead of two or three may not feel like it’s going to solve your problems, but it adds up. Paying your bills on time to avoid late fees and interest may not work miracles, but it avoids adding new problems, and that’s a pretty big deal.

Small decisions adding up to big changes. That’s the hardest part for most of us. Given the choice between a brutal battle to the death with a spikey, venom-spewing beast or truly changing our mindset towards budgeting and spending over the course of the year, many of us would probably take our chances with the monsters.

That’s OK. You can do this. It may not be easy, but it doesn’t have to be as hard as it sounds. And you don’t have to do it alone.

Debtry is here to help you every step of the way with the right tools and education.