Debt Consolidation

Debt consolidation refers to any financial arrangement which allows you to combine multiple debts into a single monthly payment. It’s a single loan to pay off multiple other loans. (You’ll sometimes hear it called a “bill consolidation loan” or “debt settlement loan.”)

The right debt consolidation loan means that instead of trying to keep up with a half-dozen different bills each month, you keep track of one. It often means fewer late fees, lower overall interest, and more flexibility with your monthly finances as you pay down debt. Ideally, a debt consolidation loan will carry better terms and a lower interest rate than most or all of the debts it replaces.

In many cases, a bill consolidation loan will allow you to pay down your total debt more quickly by letting you focus your payments and eliminating so many different fees and charges from multiple debts. Some creditors will offer a discount for paying your balance in full if you let them know you’re taking out a loan to pay off debt. Just as importantly, however, the right bill consolidation loan helps you reclaim a sense of control and responsibility for your finances. It puts you back in control of your debt, instead of your debt being in control of you.

There’s a reason it’s called “debt relief.” Debt isn’t just about dollars amounts and creditors – although it certainly involves both. It’s about anxiety, and distress, and a sense of losing control. Debt consolidation is about regaining your sense of order and direction. It starts with organizing your finances and dealing with creditors, but that’s not where it ends. Debt relief loans haven’t done their job unless we experience what the name suggests – some sense of “relief” – by the time we’re through.

Not all debt is evil. Most of us find it necessary to take on reasonable debt in order to purchase a home or finance a vehicle. We all know at least one person who manages to actively maintain two or three credit cards without letting their balances get out of control or requiring debt financing. Some of the wealthiest people in the U.S. use debt strategically to make purchases without reducing their savings or investments.

And yet, overwhelming debt creeps up on us. We use a few credit cards, we buy a decent vehicle, and we take out student loans to invest in our future income and personal fulfillment. We work harder and harder, it seems, but we start missing payments – maybe because we’re distracted, or maybe because we’re waiting for payday. Late fees start adding up, and before we know it… we’re paying and paying but owing more and more.

Other times, we do everything right. We make every payment on time, we start a small savings account, and we’re still able to do things with the family from time to time. Then it hits – the job loss, the medical bills, the essential repairs. Overnight, we go from secure and responsible to avoiding phone calls and parking in our neighbor’s garage to protect our only transportation. It can be absolutely crushing.

If I’m having trouble keeping up with my expenses, I have several options to consolidate my debt. Some depend on what type of debt it is. If I’m drowning in student loan debt, for example, there are different factors to consider than when I’m exploring payday loan consolidation.

Paying off student loans can sometimes be partially addressed through loan forgiveness programs – working in specific professions or geographic locations in exchange for student loan debt relief. There are sometimes deferment options built into the original terms of the loan which allow you to avoid the need for student loan debt consolidation altogether.

None of these are true of payday loans. These tend to be aggressively managed and are designed to ramp up interest and fees as quickly and often as possible. The only real factor when considering payday loan consolidation is how quickly you can get it done in order to avoid further damage.

As you’re considering different types of debt consolidation, it’s not simply a question of finding the best options for debt relief or the bill consolidation loan. A better approach is to consider the best options for debt relief in your circumstances, or the best debt consolidation loans for you.

This is what most of us think of when we first consider debt consolidation. A personal loan is exactly what it sounds like – a loan based on your personal credit history, current credit score, and your assurance that you’ll pay it back according to the terms of the agreement. Personal loans don’t generally require collateral, so you’re not risking your house or car if for some reason you’re unable to make your payments down the road. The lender provides the money in a lump sum, allowing you to pay off your various debts immediately. You agree to a repayment schedule, generally at a fixed interest rate, so that you pay the same amount every month due at the same time every month for a set number of months. When you’ve made the required number of payments, you are paid in full and the loan is concluded. The obvious advantages to using a personal loan to pay off debt is that the process is straightforward and clearly defined. It works the same no matter what your debt consolidation is paying for. Whether you’re paying off car loan debt, wiping out medical bills, paying off student loans in full, or using it as a credit card consolidation loan, the terms are the same. You don’t have to risk your personal property in the process, and everyone’s happy when it’s done. There are two potential disadvantages to a personal loan to pay off debt. Chances are your credit isn’t what you’d like it to be if you need a debt consolidation loan in the first place. While you don’t have to be behind on your bills or wait until you’re drowning in student loan debt or other obligations, that’s when most of us start considering debt relief loans. Damaged credit means higher interest rates on personal loans – even those intended to help you repair that damage. At the same time, lenders want you to be able to make your payments and take care of your medical bills, pay those contractors, catch up on your credit cards, and get out of student loan debt. They don’t make money unless you’re able to pay them, so most will work with you to negotiate a plan you can both live with. The other potential disadvantage is true of any loan to pay off debt or other form of debt relief. Once your bad debt is resolved, your credit score may climb rapidly. Your credit report will show that you’ve paid off numerous debts. Creditors who last month were sending ugly letters will suddenly inundate you with special offers for credit cards, personal loans, and the like. There’s no way to sugar coat the only acceptable response: don’t get into new debt while you’re still paying off the old debt. Resist the temptation or you’ll end up much worse off than before. Debt consolidation isn’t just about dollars and creditors – it’s about taking more effective control of your personal and small business finances.

Home equity loans come in several varieties. Each allows you to borrow against the equity you’ve built up in your home. Your equity is the current value of your property minus the balance you still owe on your mortgage. Most home equity loans don’t allow you to borrow the full amount of your current equity, but if you’ve been in your home for a decade or more, they can still be a powerful financial tool. The most common form of home equity loan to pay off debt is a simple fixed-rate loan, often referred to as a “second mortgage.” The borrower receives a lump sum to be repaid on a predetermined schedule, just like your original house payment. When the last payment is made, you officially own your home and your debt consolidation loan is paid in full. The other common form of home equity loan is the HELOC – home equity line of credit. Under this system, you don’t receive a lump sum up front but instead withdraw or utilize funds as needed up to a predetermined limit. As you make payments on your balance, those funds become available again. It’s a bit like having a low interest credit card backed up by your home equity. The HELOC structure is useful when doing major renovations to your home or in other situations where you need ongoing access to flexible and varied funding. It’s not generally a practical tool for debt consolidation. The obvious advantage to using a home equity loan to pay off debt is that you’ll usually secure far better terms than those possible with a personal loan for debt financing. Your credit score and credit history still matter, but the lender is protected by their claim on your home should you default. This is also a potential disadvantage. If you lose your job or find yourself unable to keep up with payments on your bill consolidation loan, you could lose your house.

A balance transfer is a specific form of debt consolidation usually limited to credit card debt. It can be thought of as a credit card consolidation loan, but that’s not technically accurate in terms of how a credit card balance transfer is structured. Let’s say you have several high interest credit cards with high balances. You discover there’s a different credit card offering an insanely low interest rate for the first twelve months or longer if you open and account and transfer your existing balance. You apply, and you’re accepted! You transfer the balances from your multiple high interest credit cards to the new, low-interest card. Now you only have one credit card payment to make, and at a much lower interest rate. That’s what makes this a credit card consolidation loan of sorts. A balance transfer can be a great tool if you’re able and willing to make substantial payments towards your credit card debt during the introductory rate period. Keep in mind, however, that eventually that promotional rate expires and a much higher interest rate kicks in. That rate matters, because it’s what you’ll be paying on however much of your balance remains when that date arrives. The other potential downside to credit card consolidation loans via balance transfer is the same as most debt consolidation options. The moment you transfer those balances, you’re the proud owner of multiple credit cards with high limits and zero balances. Your credit score will bump up, your credit history will look nicer, and you’ll be the popular kid in town with every credit offer out there. Even if you ignore these new suitors, those paid-in-full plastic rectangles are there in your wallet lonely and begging for attention. They want very much for things to go back to how they were – when you worked for them. Leaving those cards open and not using them helps bump up your credit score, but put some distance between yourself and temptation. Lock them in the safe with your passport and savings bonds. Stick them at the bottom of a locked drawer for emergencies only. Freeze them in ice to prevent easy access. If you know that won’t work, close the accounts. Better to sacrifice a few credit score points than end up overwhelmed by credit card debt again.

It’s important to clarify our terms here. Debt consolidation companies (or “loan consolidation companies”) offer to coordinate your debt consolidation and deal with creditors for you to work out payoff discounts and such. Most charge high fees for doing so and offer very little you couldn’t do yourself. If one of the primary purposes of debt consolidation is to take more effective control of your personal or small business finances, paying someone else to handle it for you is going the opposite direction.

These are not to be confused with debt management services or legitimate credit counseling organizations. Look for certification by the NFCC – the National Foundation for Credit Counseling. Debt management and credit counseling services often operate as non-profit or not-for-profit organizations. They help you learn to better manage your debt while negotiating with creditors to keep you out of bankruptcy. Many times they’ll seek to avoid the need for a debt consolidation loan by acting as a go-between for you at minimal or not cost.

Generally speaking, debt consolidation companies are unnecessary. Debt management services certified by the NFCC, on the other hand, can be your best friend in the financial world.

If you’re ready to get serious about debt consolidation and getting out of debt, start by getting your information in order. Detail your monthly expenses – groceries, utilities, house payment, car payments, credit cards, and everything else. Compare these to your income – how much are you paying on debt at the moment and how much can you afford?

Look at your debt consolidation options and decide which ones make the most sense for you. Then shop around. Don’t accept the first offer you receive. Ask your local bank or credit union what they can do, then compare their offers to those of online lenders as well. There are many reputable lenders able to offer surprisingly competitive terms. Many even specialize in debt relief loans and other bad credit situations.

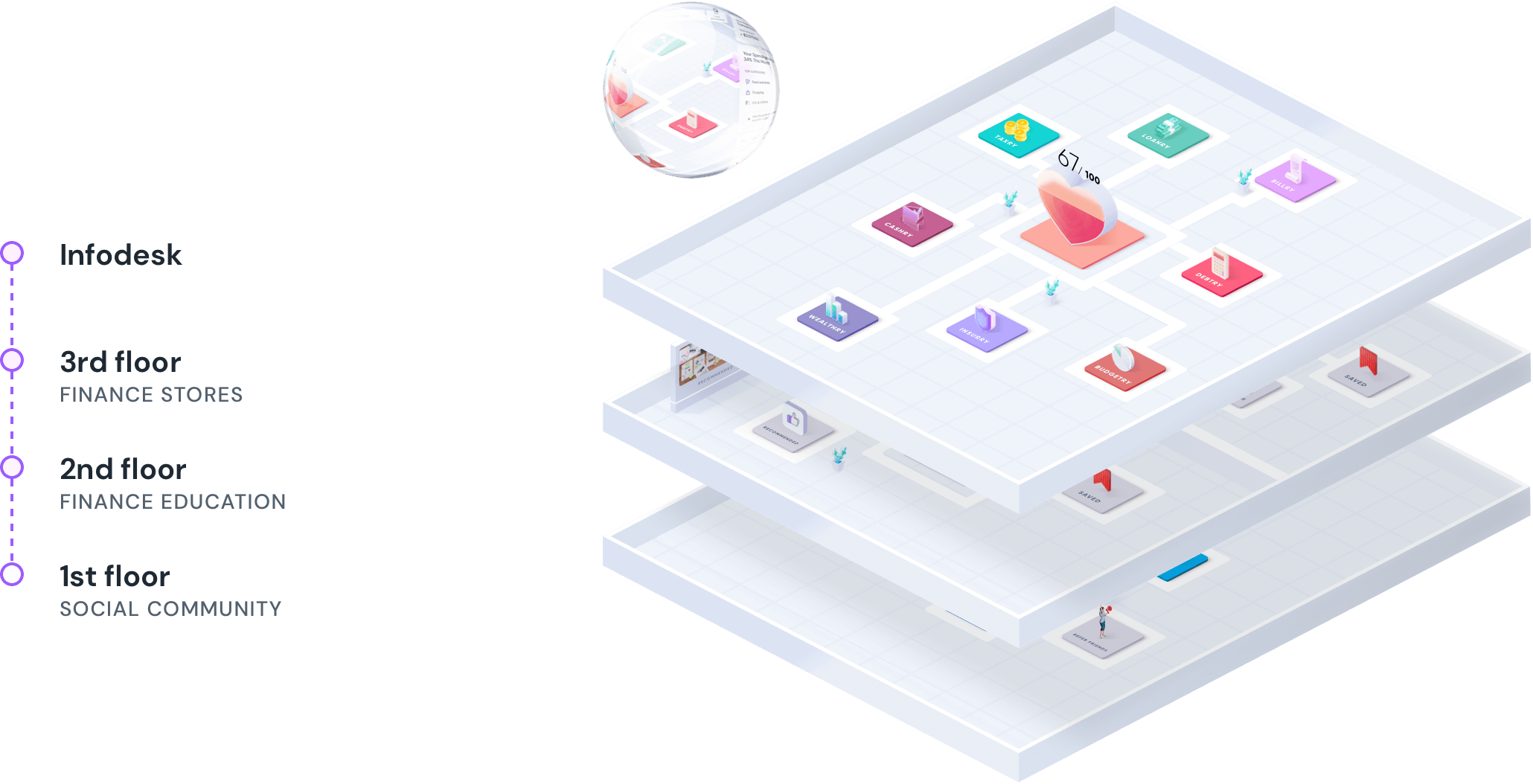

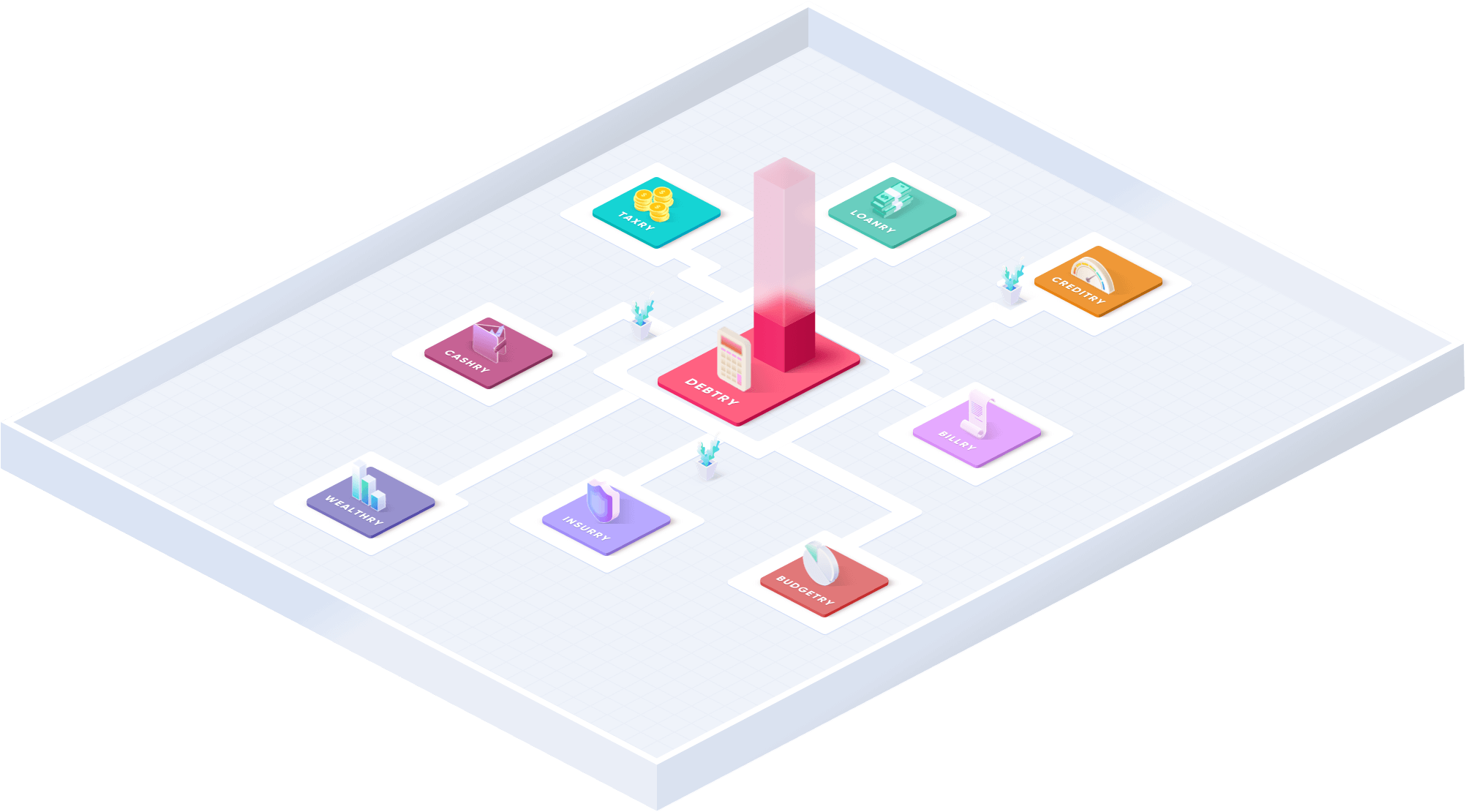

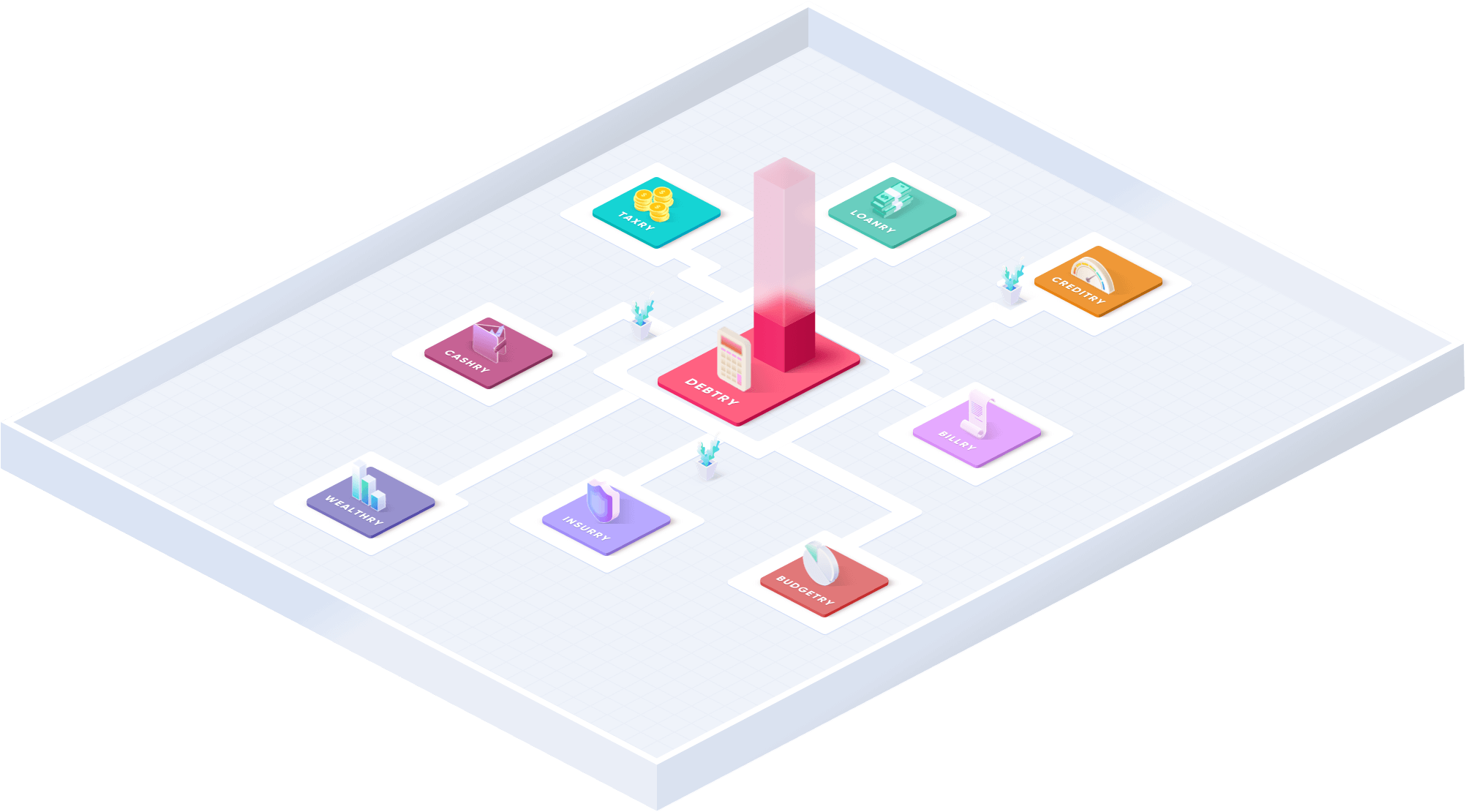

Keep an eye on this site, as we’ll soon be unveiling a series of unified financial apps to help you take more effective control of your personal and small business finances. Imagine managing your debt with a few swipes or clicks and comparing options as easily as you check social media. Imagine instant notifications anytime there’s unexpected activity in one of your accounts and helpful reminders when payments will be coming due. Half of debt management is information and organization – two things 21st century technology excels at providing.

At Goalry, we have a rather lofty vision. We believe that most of us, if provided the right information, tools, opportunities, and connections, can take more effective control of our personal and small business finances. We believe that personal and small business finance may not always be easy, but it doesn’t have to be as hard as it often seems. We also believe that no one should have to figure it all out alone.

Educate yourself about debt, both before and after you choose a debt consolidation option. Take advantage of the Goalry blogs and other reputable financial sites so that you gradually take more and more effective control of your future. Money isn’t everything, but it impacts almost everything. The better we are at using our money efficiently, the less we have to worry about our finances all the time and the more we can focus on the things that really matter in the end.

We live in complicated times, and debt can be overwhelming. Personal finance may not always be easy, but it doesn’t have to be as difficult as it sometimes seems. And you don’t have to do it alone.