Is Debt Settlement Ever a Smart Option: Lifeboat Rescue

With debt settlement, this means that a creditor has agreed to accept less than the amount you owe as full payment. It also means that a collector can’t continue to hound you for the money you owe and you don’t have to worry that you could get sued over your debt.

It may sound like a good deal but settlement can also be a risky option. It can destroy your credit and it can be costly. Reaching a settlement can also take a long time to accomplish and even if you are successful, it can take years and you may still owe taxes on any forgiven debt.

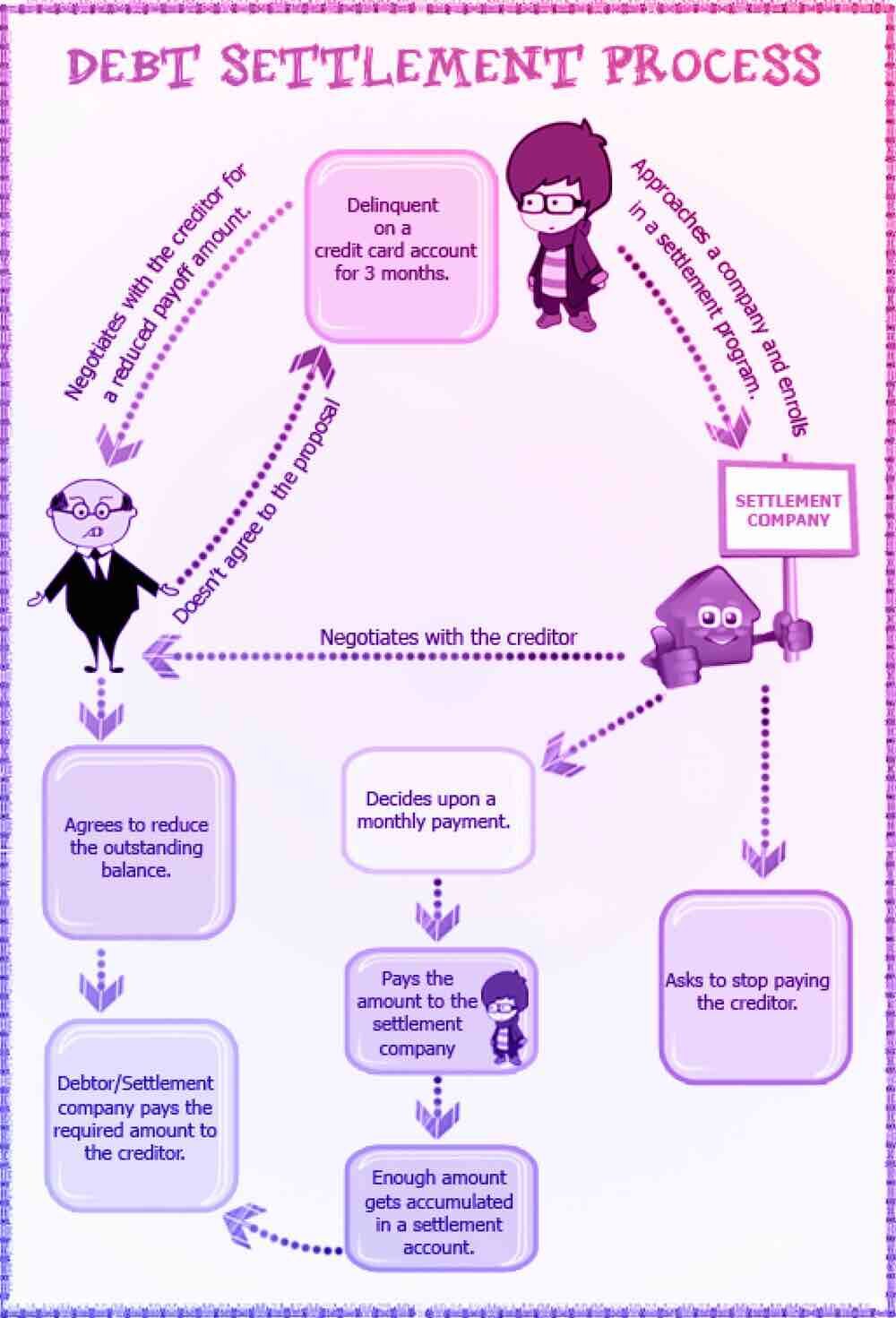

The Process of Debt Settlement

This is a multi-step process and there are different decisions you will need to make throughout it.

- 1. Choosing whether to Hire a Lawyer or a Debt Settlement Company to Negotiate Your Settlement

You can also do this yourself. Since the goal is to reduce the amount you are paying, experience helps. If you don’t have enough money to make a lump sum offer then be sure to start saving immediately.

- 2. Meet with the Original Lender and Ask if the Company is Willing to Settle

If the account is more than six months past due then this has likely been moved to a collection agency. It’s important to note that the collection agency has the opposite goal as you and that’s to get as much money from you as possible.

- 3. Save Enough Money for an Offer

It can take years for you to be able to save up enough money in order to make an offer. Usually, you will stop paying the creditors and send monthly payments to a representative to build an account. During this time, the interest charged on the debt grows, as does your account balance.

- 4. Make an Offer

You need to be patient during the process since creditors don’t have an obligation to accept any debt settlement offer you make. This could take months but it can also take years. If the creditor does accept, you want to get it in writing. Ask the creditor to send a notice that the debt has been settled to the major credit bureaus.

- 5. You Can See if You Saved Any Money

The companies will charge about 15% of the amount you owe or 25% of the amount you save. Lawyers charge either a standard fee or an hourly rate. You can also owe taxes to the IRS on the amount of debt that was forgiven. You may not come out ahead after the process is complete.

Types of Debt Eligible for Settlement

Medical bills and credit cards are some of the ideal debts for the process since if you file for bankruptcy, the medical facility and credit card company may get nothing. Many people have trouble paying both credit cards and medical bills and much of this debt is seriously delinquent, which makes them qualified.

If you have federal student loans, this can actually be much trickier. If you have defaulted then the government only allows a collection agency to accept a lump payment under three certain conditions. You either pay the balance and interest but not the charge for the collection agency, you pay the principal plus half the unpaid interest, or you pay 90% of the remaining interest and principal. Since banks usually issue private student loans you may be able to reach a settlement with these.

Working with a Debt Settlement Company

This is one way to go through the process. These companies usually have experience negotiating with creditors and some have relationships with major creditors, especially popular credit card companies.

When you reach out to one of these companies, they are staffed with credit counselors and those who can analyze personal finances. The staff always has an understanding of the marketplace, including why and how creditors will negotiate a settlement.

When your finances are detailed, the counselor will check your debt and draw out a settlement plan. You will then be presented with the plan. The plan should include details about the monthly payment structure and how the company is going to get paid.

Finding the Right Debt Settlement Company

Experts suggest you look for a number of features when choosing a debt settlement or debt service company to determine its legitimacy. You want to make sure the company is professional, transparent, and fair. Creditors don’t have any legal obligation to consider settlements so the company you choose should not guarantee an agreement, even if they have plenty of experience.

A good company should disclose all the fees and costs before you sign up. It should have easy-to-understand, written policies about its program. It should also be able to give you an estimate of how many years or months it can wait before making an offer to the creditor.

The company can give you an estimate of the intended results but should never guarantee a specific resolution program. The company should tell you how much money you save before it begins to make offers to your creditors and then send all resolution offers to you for approval.

The Risks

Many experts believe that debt settlement should be the last resort because of the risks associated with it.

Your Credit Takes a Hit

If you aren’t already delinquent on these accounts then you will be once you redirect debt payments toward the settlement account. Delinquent debt and accounts charged off by the lenders stay on a credit report for seven years.

Interest and Penalties Continue to Accrue

You will usually be hit with penalties, fees, and large charges. Interest continues to rack up on your balance.

There Is No Guarantee for Success

There aren’t any guarantees that a company will be able to resolve your debt. There are some creditors that won’t negotiate with large companies or at all. Many consumers would have to settle at least four different accounts in order to see a benefit. During this time, the debt total continues to rise and fees accrue as aggressive collection attempts are made.

You Pay a Fee Once the Debt Settles

By law, a settlement company can’t charge you any upfront fees and they instead charge a percentage of each debt as they settle. For example, if you owe $10,000 and the agency negotiates a settlement for only $5,0000 then you get charged 25% of the balance.

You Also Pay Additional Fees

Besides the fees you have to pay to the company when the debt finally settles, you may also face other fees. There can be setup and monthly fees in order to maintain the account created under the program.

Forgiven Debt Can Be Taxable

The IRS actually views forgiven debt as income. You will need to work with a tax professional to learn about any extra tax obligations you have when you settle your debt.

If you do work with a professional or company, you need to keep your guard up. It can be very easy to let your guard down when you are under mounds of debt and feeling desperate. Many companies may not be worthwhile and you can get in even more financial trouble.

Difference Between Debt Settlement and Debt Management

Many people think that debt management plans and debt settlement programs are the same. This isn’t the case. Both do help consumers get out of debt but debt settlement plans can leave your credit in worse shape.

How Does Debt Management Work?

With debt management, clients work with a nonprofit credit-counseling agency. The agency provides support and guidance and is focused on the financial well-being of the client. The agency negotiates with creditors to get lower interest rates and eliminate fees. With this process, clients can pay off more of the balance with each payment and allow debts to be paid in five years or less.

Usually, you will make one monthly payment to the agency and the agency then divides it up and pays each creditor. This can help simplify the bill-paying process and eliminate any missed payment fees. These plans also include continuing financial education that can help clients avoid these debt problems in the future.

Unlike some other options to improve debt, those on a debt management plan usually find that credit improves as they work through it. When you complete the plan and pay off the debt in full, you are able to pursue other financial goals, such as purchasing a new car or buying a home. Debt is paid in full and there are no tax obligations moving forward.

How Does Settlement Compare with Management?

Debt settlement appeals to consumers because instead of repaying all your debt, you are only repaying a portion. Another main difference is that it is offered by for-profit companies and the focus isn’t on your financial well-being. The goal is to generate a profit for the company. Once the creditors do accept the lump sump payments then your accounts are technically paid off, but in many cases, the drawbacks can outweigh the short-term relief.

When you choose settlement, you may not be able to pursue other financial goals due to the impacts on your credit. Lenders may not be willing to give you a chance for several years to come. There are also more tax implications with a settlement and you have to pay taxes on any debt that is forgiven.

When you are choosing between these two, you should look at your long-term financial plans instead of what is the most convenient in the near future. You have to make the best decision for you but there are many more benefits if you pursue debt management instead of debt settlement.

Myths about Debt Settlement

There is a lot of misinformation, so you may have heard some of these myths before.

Myth 1: You Have to Work with a Company since Only These Companies Can Negotiate with Your Creditors

Consumers can call to negotiate lower interest rates or their own deals at any time. Additionally, nonprofit credit counseling agencies can also help negotiate with creditors as part of a debt management plan.

Myth 2: It Is the Quickest Way to Get out of Debt

If you have a problem with credit card or other debt, it’s likely not going to just suddenly disappear. Debt settlement plans are not quick and can take an average of three years from start to finish. You make payments in an escrow-like account until there is a balance high enough for a settlement. The company also encourages you to stop making payments on accounts while they are negotiating terms. This leads to other fees.

Myth 3: It Can Improve Your Credit Score

The opposite is true and debt settlement actually hurts your credit score. Since you are paying only a fraction of the debt owed, it lowers your score and can lower your score almost as much as declaring bankruptcy does. Staying out of debt following a settlement can help you improve your score but it takes time for that to happen.

Get Advice on How to Manage Debt Better. Debtry Can Help You.

Myth 4: Bankruptcy is the Only Other Option to Get out of Debt

There are several options and both of these don’t have to be your only ones. You can work directly with creditors or you can work with nonprofit credit counseling agencies to help contact creditors on your behalf.

Myth 5: You Can Get out of All Types of Debts with Settlement

There are many different types of debt that it won’t eliminate and this includes back taxes, court-ordered alimony, child support obligations, and student loans. Secured debt, such as vehicle loans and mortgages, may also not be discharged through it.

How Does Debt Settlement Affect Your Credit Score?

It can have major implications for your credit. There are a number of ways settling your debt can affect your score for years to come.

Missing payments

As part of the process, you are advised to withhold payments to creditors, which allows your accounts to become delinquent. This is done as a negotiation tactic to convince the creditors to take the lump sum payment for much less than the total amount of debt. This is not just one or two payments that you are missing. The process can stretch out for several months so you will have a lot of missing payments on your credit report.

Lower Credit Score

Since your payment history accounts for 25% of your credit score, the months of missing payments cause your credit score to drop. Even though debt settlement can mean that your accounts are eventually paid, the history of missed payments and the lower credit score makes it harder to find any lenders that want to give you any additional credit. Those that are willing to take the risks are going to charge higher than average interest rates.

Not all debts are going to be settled

Even if you end up settling your credit card debt, you still may not end up debt-free. Some debts can be settled and the long-term damage you are doing to your credit just to settle some of your debts likely isn’t worth it.

Alternatives to Debt Settlement

There are other options if you don’t want to go ahead with debt settlement.

Negotiating with Creditors Yourself

You don’t need to work with a company in order to negotiate with creditors yourself. You can call creditors directly to discuss and possibly lower your interest rates. It’s unlikely that you will be able to negotiate a lump-sum settlement or lower payments but you can do this yourself. However, if you are able to negotiate lower interest rates, they can help you pay off your debt faster and make the monthly payments more manageable.

Debt Consolidation

In the process of debt consolidation or debt financing, a borrower will take out one big loan to pay off smaller debts and in the process can usually get a lower interest rate. The debtor pays one bill each month instead of several bills.

Therefore if you do opt for this option in the end, we can help you find a suitable lender. You just need to fill in the basic information in the form below, and we will connect you to a lender in no time:

Debt Management Plans

With credit counseling, agencies can help set up low-interest debt management plans so borrowers can pay off their debt over time. A debt management plan reduces monthly payments so borrowers eventually do pay off the debt in full.

Bankruptcy

Filing for personal bankruptcy is always a last resort and can be the worst option for anyone who is battling debt problems. However, it is an alternative. Bankruptcy can negatively affect credit, delay or prevent foreclosure on a home, and lead to a repossession of a car. Filing for bankruptcy can also be costly and quite complex.

Negotiating with Creditors on Your Own

Before you start negotiating with your creditors, be sure you know your rights. Collectors are bound by certain practices but they can violate these laws. If you know your rights then you will have a stronger position. If you are so far behind on your payments then it’s like creditors are calling you every day and night and the easiest way to start is to say that you would like to settle the debt.

How to Talk to Creditors

If you aren’t hearing from creditors every day, you can still negotiate a plan. When you are speaking with creditors, act confident, expect respect, ask for clarification if something doesn’t make sense, don’t agree to any terms unless you fully understand what is expected, and don’t agree to anything unless it is in writing.

It’s important to maintain a positive tone and atmosphere when you are speaking with creditors. A bill collector may be unpleasant but if you are positive and professional, it can help your chances of getting a settlement. People are going to be more willing to work with you if you have a pleasant attitude.

Start with Lower Offers

While the strategy is to pay as little as possible, you have nothing to lose by starting low. You shouldn’t be making the highest offer you can afford at the beginning. The creditor will likely counter you and raise the amount. If you start low then this means that it’s more likely the creditor's offer can be closer to what you can pay.

Have a Written Settlement Agreement

You need to have your settlement agreement in writing. This protects you if you pay the creditors and then the creditor later changes its mind and wants payment for the remaining amount. It’s also absolutely necessary in a case where the creditor has already sued you. The agreement should always be in writing. It’s not necessarily cost-effective to have an attorney look at the agreement but legally it is in your best interest to take this step.

When Is Debt Settlement the Right Option?

It may be the best option in a few scenarios. If you have the money to make a lump payment then you likely can afford monthly payments. Since you still have to pay a large portion of what you owe and it also ruins your credit, it may not be as advantageous as bankruptcy. If you are in short-term trouble and have things turning around then forbearance can be a better option.

Settlement can be the right choice when the debt can’t be discharged with bankruptcy, such as student loans. It may also make sense if you have access to money that you can use to pay off the settlement but that isn’t available for your monthly payments. It can help if you are in a situation where you are unable to get a consolidation loan or have debt you can’t consolidate.

There are some benefits of debt settlement that may make it the right option for you.

Avoid bankruptcy

One of the biggest reasons why people would choose settlement is to avoid declaring bankruptcy. Bankruptcy can be a debt solution that will follow you for the rest of your life and bankruptcy remains on a credit report for 10 years. Many credit, loan, and job applications will ask you if you have ever filed bankruptcy, no matter how long ago it was. If you answer no and the bank finds out you did then you could be guilty of fraud. If your employer finds out, you could lose your job.

When you settle debts correctly with creditors, you can avoid filing for bankruptcy and dealing with those consequences. Debt settlement only remains on the credit report for seven years and there won’t be any public record of it. This means once the time limit has run out you won’t have to deal with settlement anymore and can move on with your life.

Get Relief from Debts That Are Overwhelming

The goal of debt settlement isn’t to get one over on creditors and only pay them a portion. You can’t rack up a large amount of debt and then have the expectation that you can settle it. However, if you are having difficulty paying back what you owe then debt settlement can help. Once you have paid your settlement you are technically debt-free and it may be in less time than if you had tried to pay your debts back on a typical repayment schedule.

When you compare bankruptcy to settlement, creditors don’t get much from you if you used Chapter 13 bankruptcy. Creditors might not get anything from you at all if you file Chapter 7 bankruptcy. Creditors know the facts about bankruptcy, which is why they usually accept a settlement.

Repay debts in less time

Even though debt settlement takes a long time, you can repay your debts in a few years, with the average being three. This is much less time than you would be spending paying your debts back if you went through a normal process. If you are considering settlement then paying your debts back normally likely isn’t an option. Debt consolidation, Chapter 13 bankruptcy, and credit counseling have periods that are much longer. It can even take decades to pay back debt if you stick to a regular payment schedule. A debt repayment calculator can show you how long the process would normally take for your specific debt.

To Sum up

Debt settlement may seem like one of the only options if you are in over your head when it comes to debt. While the process sounds like it can be beneficial since you are only paying a portion of what you owe, there will be consequences for years to come for your credit report. Before you begin settlement, you want to make sure that you have looked at all your options.

If you choose to go through the process, you need to carefully research the company you choose to work with and remember that the company may not have your best interests in mind. When negotiating with creditors yourself, get everything in writing. There are a few instances where it can make sense but in many cases, it may not be worth the hassle and damage to your credit score.