Total Debt vs Total Liabilities Explained

To diagnose the financial health of a company, one of the basic tests is to analyze its debt ratio. It is a measure that assesses the degree of financial risk based on the volume of external resources used. External financing is recorded in the form of obligations and total debt. They are third-party funds that must be returned, with special relevance for financial debt because it also includes the payment of interest and expenses. To better sustain the level of indebtedness and guarantee the ability to pay, it is essential to strengthen liquidity.

Before an explanation is provided as it relates to total debt vs total liabilities, it is imperative to know the terms and what they mean.

Total Debt

Total debt is the sum of the so-called current and non-current liabilities. It must be taken into account that this ratio indicates how leveraged, through external financing - both long and short term - that the company is. When we analyze a company's balance sheet, total liabilities are usually classified into three categories. Adding the short-term, long-term, and other liabilities, we will obtain the total debts.

Total Liabilities

Liabilities or debts represent an obligation between one party (the debtor) and another (the debtor) that has not yet been repaid. They are settled or settled over time, generally in money, although they can also be dealt with goods or services.

There are many passive types, for example:

The payment of the lease or rental of the premises where the company operates

Bills that are owed for utilities

Bonds issued to investors

Corporate credit card debt

All this is part of the total debt of a company, but there is more. For example, money received by a company for a service or product that has not yet been provided to the customer. This should be recorded on the liabilities of a company.

In a Nutshell:

Total liabilities are the combined debts owed by a company (or an individual).

As a general rule, these liabilities are divided into three categories: short-term, long-term, and others.

On a company's balance sheet, total liabilities plus equity should equal total assets.

What Is Debt Ratio?

The debt ratio exposes possible financial imbalances between debt and equity. Therefore, it is important to know what it is, how it is calculated, and what analysis can be extracted from its result. The objective of a ratio is to relate two magnitudes to measure and evaluate the proportion of one with respect to the other, and also comparing the result at different times. In this case, it is a matter of confronting the two main groups into which the Liabilities of the Accounting Balance are divided.

The principle of double-entry that governs accounting implies that every item must have its counterpart.

Liabilities are divided into:

PASSIVE Net worth (Capital that belongs to the company)

CURRENT LIABILITIES

(Debts and obligations with third parties)

Non-current or fixed liabilities (long-term)

Current callable liabilities (short-term)

The debt ratio (RE) measures the relationship between the two sources of financing of a company: own and other resources. In other words, it expresses the proportion and the way in which creditors and investors participate to finance the company.

Analyzing the relationship between debt, liabilities, and equity gives visibility to the real situation of a business. This is so because the wealth of a company is not measured only by what it has, but by the structure of its capital, which is the balance between what it has and what it owes.

How Is It Calculated?

To calculate the debt ratio, the first thing to do is prepare the Balance Sheet on the date chosen for the analysis. Once prepared, the sums representing the net worth and the payable liability are taken:

Equity:

Capital

Result of previous years (+/-)

Grants and donations

The qualifier "net" expresses that any capital loss is discounted, especially due to negative results in previous years. They are losses that the partners bear.

Callable liability or external financing

Calculation of the debt ratio (RE):

Debts and obligations with third parties are part of the company’s liability total in the form of loans or credits with financial companies and other debtors for commercial or business activity (suppliers and creditors).

As we have seen, it is divided into:

1. Current or current liabilities: short-term accounts payable, before one year.

2. Non-current liabilities: long-term debts, more than one year.

There are two ways

1. Directly compare debt with equity.

2. Compare it with the total liabilities.

There are other things to consider when it relates to Total Debt vs Total Liabilities. A third very useful alternative is to divide the ratio in two: separating the long-term and short-term liabilities.

Balance Sheet

A balance sheet uses the accounting formula or equation:

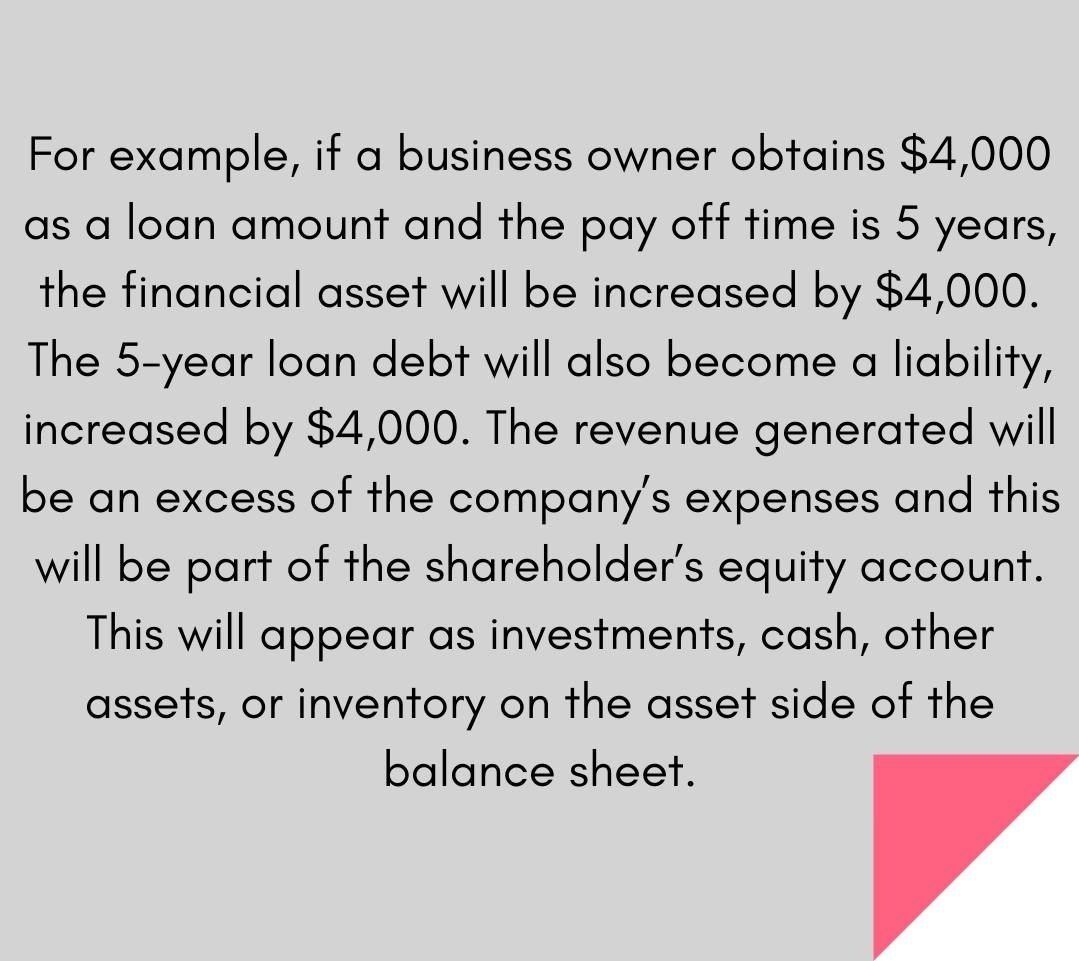

Assets = Equity + Liabilities

This formula or equation is insightful. It tells the business owner what is exactly going on with the company’s revenue and expenses. In some cases, it shows whether the company has to borrow money, which means more liabilities. It also shows the assets owned and the expenses associated with each asset, if that is the case. It indicates the equity that each shareholder holds.

Debt Ratio Indicators

As it is a general indicator, it is exposed to differences in interpretation depending on the activity or type of business. For instance:

Industrial or construction companies need more investment and can have a higher level of indebtedness without this being serious. It just has to be well planned, with most of the long-term debt and with good profitability prospects relative to cost.

Service companies need to be closer to maintain a balanced ratio and guarantee the ability to pay.

The short-term debt that comes from commercial credit -deferrals granted by suppliers to pay bills, is an advantage to be able to use the goods and services acquired without paying for them immediately.

Short-term and long-term debt ratio

Debt is one of the four fundamental financial measures of a credit rating, so it determines, together with solvency, profitability, and liquidity, the ability to access financing for companies under favorable conditions. There are hundreds of debt indicators, but we present the ones that are fundamental. It is important to differentiate the time horizon of the obligations. The debt that must be faced in the short term, before a year, is not the same as that which has a longer-term. This allows you to use two measures depending on the payment term.

The general ratio is separated into two: short-term debt ratio and long-term debt ratio. This makes it possible to differentiate the relationship between the due debt, both short-term and long-term, in relation to the total equity.

Debt Ratio: Debt/Total Liabilities

The classic debt ratio measures the ratio of debt to all liabilities, and is an indicator of the company's dependence on external financing, both in the short and long term. This ratio varies greatly, depending on the sector to which the company belongs, but as generally normal, it should be between 40% and 60%.

If it is above, it means that there is an excessive dependence on third-party resources and that the solvency is low. On the other hand, below the range, means that the company has an excess of idle resources since it is offering a low return on its own resources.

Short-Term Debt Ratio: Current Liabilities/Total Liabilities

It measures how much of the debt is short-term. What is interesting for the company is that most of the debt is long-term, since short-term debt dramatically reduces liquidity. The Current Liabilities, in addition to debt with credit institutions, include debt with public administrations and with suppliers or group companies, which is why the payment terms have a definitive influence and, therefore, vary greatly depending on the sector to which they belong. The size of the company is also part of the equation since this determines the bargaining power with its environment, although the ideal is that it should be between 20% and 30%.

Long-Term Debt Ratio: Non-current Liabilities/Total Liabilities

It indicates how much of the debt is long-term. What is interesting for the company is to place the debt more long-term than short-term, although it is the opposite view of what a creditor would like. Depending on the needs of the company to have fixed assets, which are very different depending on the sector, and the ability to generate profitability, this ratio will be higher or lower, with the range of 20% to 40% being the ideal situation for the company.

Debt Service: Cash Flow/Current Liabilities

It is an indicator of the company's ability to repay long-term debt, and it is both an indicator of indebtedness and profitability. As in the previous cases, there are large differences between sectors depending on whether they are more or less dependent on the acquisition of fixed assets. However, the idea is that this ratio does not fall below 15% -20%, since it would mean that the company needs more than 6.5 years of generation of cash to fully repay your long-term debts.

Working Capital: Current Assets/Current Liabilities

This ratio is both an indicator of indebtedness and liquidity, as it measures the ability of the company to respond to its short-term debts with its most liquid assets, short-term as well. This indicator must be greater than one since below it means that the company is not able to meet its working capital debts with the liquidity that it is capable of generating.

Need Extra Help Managing Your Debts? Meet Debtry.

Debt Management

Time planning is key to managing debt well. Investments in vehicles, equipment, or real estate must be financed over the long term, to pay most of it when the assets begin to pay off. If it is done the other way around, it would be the same as betting on the future seriously damaging the current solvency. In the short term, for current activity, it is necessary to look for quick and low-cost solutions. Most SMEs are financed with commercial credit, that is, they seek to pay suppliers as late as possible and speed up the collection of their own invoices.

The indebtedness of a company must be proportionate to its operating capacity. It is reasonable, and even necessary at times, to resort to external capital to boost activity, but always with good planning. In any case, it is convenient to review the accounts and reduce the indebtedness or total liabilities as much as possible. A very high ratio generates a lot of dependencies and drives away new investors because in the event of insolvency it will be more difficult to recover the money. Liquidity is a key objective. Many times, having to go into debt is a consequence of a moment of lack of cash. It is important to understand that proper asset management facilitates cash flow, fuels cash, and eliminates unnecessary risk.

Conclusion

As a general rule, companies with high levels of indebtedness, above the investment they need for their activity are usually companies that have had a more or less long period with low or negative profitability or cash generation. Therefore, it is advisable to analyze the financial pillars including total debt vs total liabilities, indebtedness, profitability, solvency, and liquidity, simultaneously to have a global vision of the financial health of the company. If you want to know more about how you can manage your debt wisely, then go over to the Goalry platform where you will be able to enter the Debtry store to gain insights on this topic.